VIE_Magazine_SEP22_article_Cryptocurrency_Follow_Up_HERO-min

A Bitcoin for Your Thoughts?

The Everyman’s Guide to Cryptocurrency

By Addie Strickland

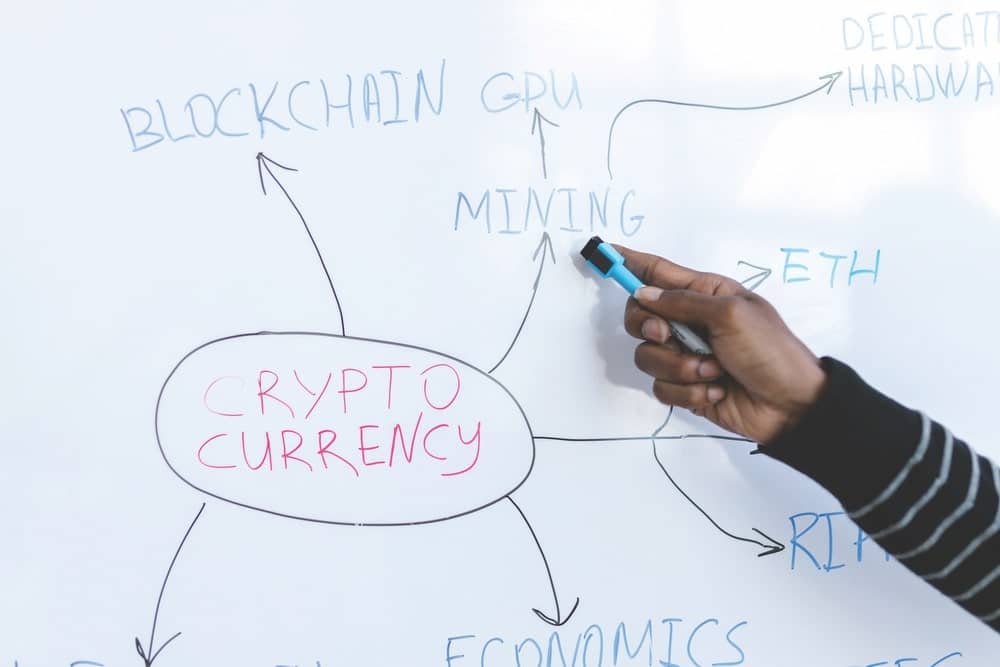

The buzzword of the year might be cryptocurrency. If you have no idea what that means, this article aims to break it down for you. Crypto is a term that encompasses everything from blockchains to investments. It is quite simply a medium of exchange that we will begin to see more of in the future. This “digital money” provides a more secure and faster form of transaction than cash or credit.

The dictionary definition of crypto is a decentralized digital currency made to be used over the internet. What does decentralized mean? Common currency transactions take place through a centralized entity, such as a bank. With a decentralized network, the transaction is sent to thousands of miners (people who mine the blockchain) instead. Once the transaction is approved, it is stored on a public ledger on a blockchain that can’t be changed. Anyone can see it.

So, what is a blockchain? Good question! A blockchain is a system that records transactions over several computers through a peer-to-peer network. There are many uses for blockchain technology outside of cryptocurrency. You can think of these “blocks” as storage units. All transactions are recorded in these storage units, which are public and reviewed by thousands of people to ensure that they are correct, instead of being stored on a server of a private third party that has complete control over your assets.

The goal of decentralization is to reduce the level of trust participants must have in an institution like a bank and encourage everyone not to put all their eggs in one basket. A traditional bank transaction, for example, would be stored on a private server. With a decentralized blockchain, the transaction would be sent to every miner, and now there is no “one beholder of the truth”—instead, there are many. The problem with the current system is that, with banks, it takes one person to slip up, and your information could be leaked. Blockchain technology dictates that every transaction is approved by hundreds of computers and stored publicly. According to Coinbase, a leading cryptocurrency exchange platform, “The blockchain ledger is divided among all the computers across the network, which are constantly verifying that the blockchain is accurate. This means there is no central vault that can be hacked, stolen, or manipulated.”

Now that we know what cryptocurrency is, the next question is, “How does it work?” Through digital currency companies such as Bitcoin, Ethereum, and Dogecoin, to name a few, you can trade, buy, and sell crypto. These cryptocurrencies make it possible to transfer money from your bank to your crypto wallet. It is a legitimate form of currency! Each currency “brand” has its own coin value; for example, Bitcoin is currently worth about $23,341.50. An investor does not have to buy a whole coin—you can make smaller or larger investments. Once invested, this currency can be spent anywhere it is accepted, just as you would use a credit card or bank account.

Another upside to crypto is that it is available to everyone—all that is needed is an internet connection. This allows for easier global trade, and cryptocurrencies like Bitcoin and Ethereum provide financial services to the unbanked. Because of this, many developing countries have a high crypto adoption rate. The most significant contributor to poverty in many third-world countries is corruption, but with blockchain technology, governments and all forms of trade will be held responsible because everything will be public. In addition, with crypto, transferring money is cheaper and faster. According to Cointelegraph, a leading digital media resource covering a wide range of news from blockchain technology and crypto assets to the latest technology trends, “Overseas workers no longer have to worry about steep transaction fees when transferring money to their home country. While traditional remittance platforms charge as much as 10 percent of the total amount, crypto-based platforms only charge around 2 to 5 percent.” In developed countries, cryptocurrencies are seen more as an investment; however, business owners can utilize them to mitigate the international price changes between fiats.

Depending on the cryptocurrency, most investors view it as volatile. Still, investors in the world of crypto are loyal, and the community has developed its own jargon. One of the most-used acronyms is HODL (holding on for dear life), essentially a rallying cry for investors to stay rather than sell their investments, with the tacit understanding that they’ll become more valuable. It is a whole new world, complete with its own language!

Another acronym is DYOR, which stands for do your own research. There are so many layers to crypto, and it’s continually growing and gaining traction with new technology. Many technological advances are released daily, and these tools are often functional but not practical or are out of reach because of their price tags; yet, with cryptocurrency, a new day dawns for all as it represents the future of economic development. The importance of this movement is to eventually bring financial freedom to every corner of the world and equal opportunity for everyone.

— V —

To read more about how the fashion industry is evolving through crypto, digital NFTs, and the metaverse, check out the article “That’s So Meta” from VIE’s July 2022 issue!

Share This Story!

KEEP UP WITH THE LATEST STORIES FROM VIE